November 1, 2023

Spotlight on Second Mortgages

Brokers

At Magenta, we know there are many reasons why clients choose to take out second mortgages. For some, second mortgages are valuable financial management strategies for dealing with debt efficiently at lower interest rates. For others, second mortgages are an avenue for funding the acquisition or improvement of homes, paying tuition for oneself or one’s family, or any one of life’s other major expenses.

Business For Self

Magenta offers second mortgages tailored to the needs of alternative borrowers whose unique circumstances may not be best served by other financial institutions. For instance, consider the small business owner looking to use home equity to fund their business. If that business has a significant cash component, it would lack the verifiable income needed to qualify for a bank loan. But with Magenta’s Stated Income Program for Second Mortgages, that borrower would only need to provide non-traditional income documents like business ownership, bank statements and other supporting documentation to qualify for a Stated Income Second Mortgage with up to 75% loan-to-value (LTV).

Rentals

Consider also the property investor hoping to get a second mortgage on a rental property, but running up against the limits banks place on the number of rental properties a borrower can have. With a Magenta Second Mortgage for Rental Properties, not only is there a 100% offset on rental income with no maximum number of doors, there is up to 75% LTV on student rentals. Furthermore, Magenta offers 2-year terms in addition to traditional 1-year terms to better suit the needs of a property investor’s longer view.

Our solutions are designed not only to address your client’s short-term credit challenges but also to help them return to traditional lending channels as soon as possible. Keep reading to find out why Magenta’s mortgages are worth a second look:

Smaller Monthly Payments

We offer up to 50-year amortization, or interest-only payments, and balance our rates and fees in favour of smaller monthly payments, passing the benefits on to your client’s cash flow.

New Longer Terms

Magenta is proud to have recently added 2-year terms as an option on our second residential mortgages, in addition to our traditional 1-year term offerings.

24-Hour Quick Closes

If a borrower’s lending institution option falls through, our team will put in the work to help you meet your client’s deadline.

Capitalized Fees

We capitalize lender fees and broker compensation, meaning the cost is added to the client’s principal and spread over the life of the mortgage.

No Notice of Assessment? No Problem

Even clients with low or no documentation verifying their income are eligible for second mortgages through Magenta, subject to only a small increase in their starting fee.

Simplified Financial Planning

We’ll match the maturity date of our second mortgage solution with your client’s first mortgage, simplifying their financial planning.

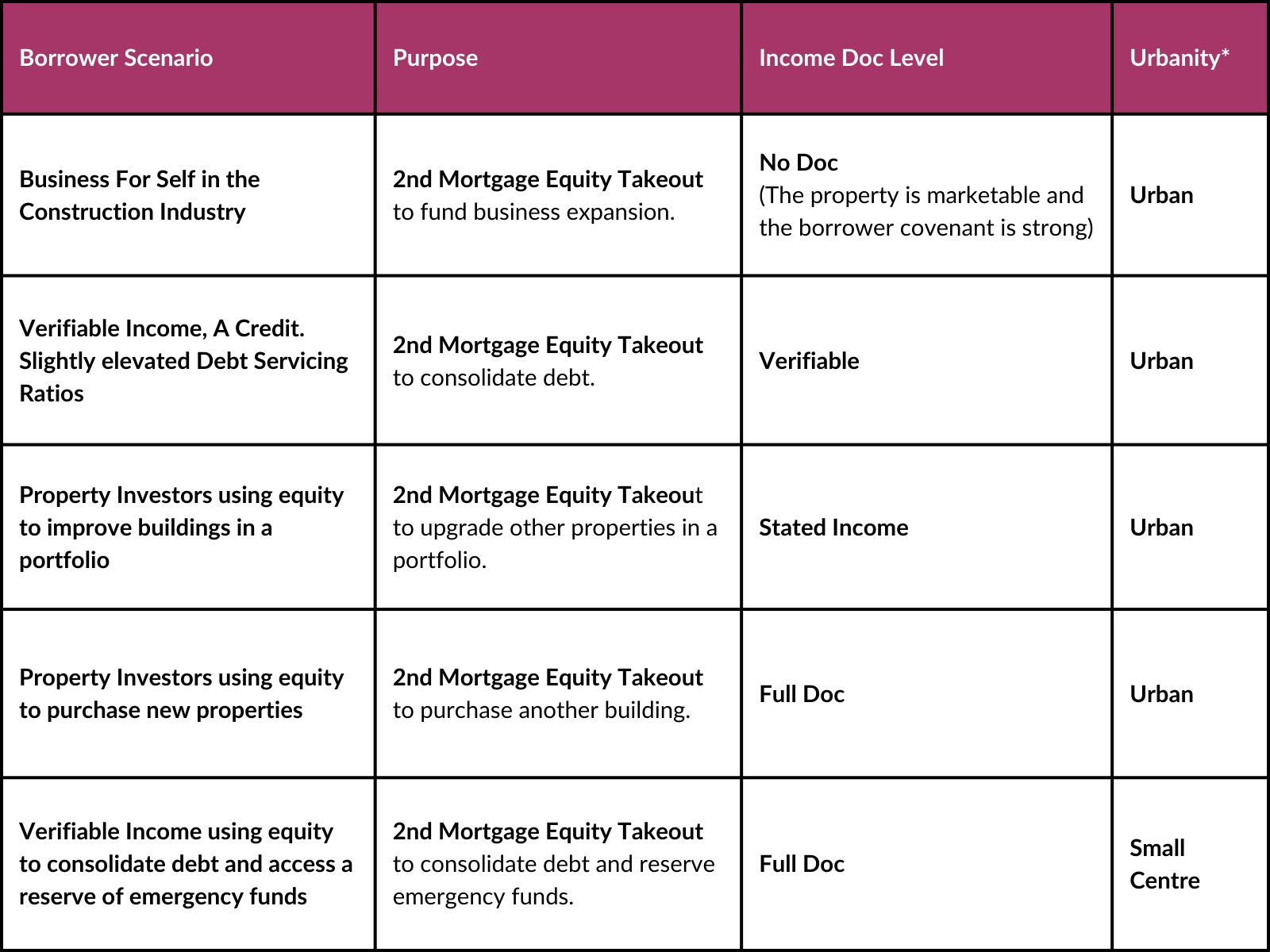

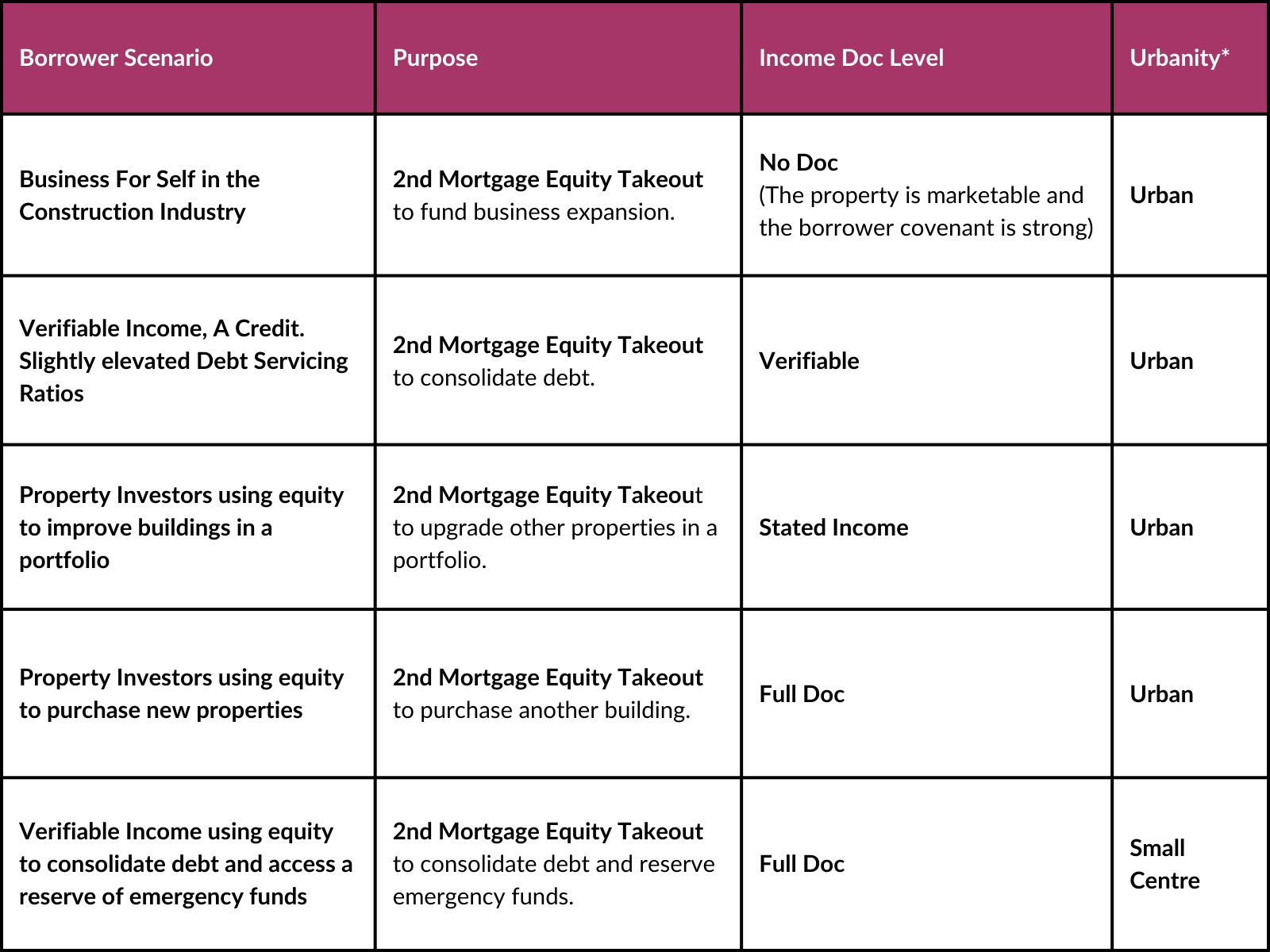

A selection of second mortgages funded this year (borrower and identifying property details have been removed):

* Small Centre refers to properties located in towns with a population of 1,000 or more within 45 minutes of one of our urban centres. Rural refers to properties with septic and well access within 45 minutes of one of our urban centres.

Second Mortgages are available in urban, small centre and rural locations throughout our lending areas. Please view our Google Map or speak with your Magenta representative to find out more.

Interested in what Magenta has to offer? Connect with our mortgage origination team, or click here to learn more.