It’s National Financial Literacy Month (FLM), where the Financial Consumer Agency of Canada (FCAC) helps equip Canadians with practical tools and tips to manage their money in a changing world. Throughout November, the FCAC is discussing the ever-changing financial marketplace and the importance of checking up on financial health.

At Magenta, our goal is to connect people with opportunities to build a better tomorrow. This month, we’re furthering our goal by supporting National Financial Literacy Month and sharing resources dedicated to helping Canadians:

- manage their money and debt wisely;

- save for the future; and

- understand their financial rights.

This week we’ll be talking about optimizing your financial health, managing your money to limit financial difficulties and improving your financial situation. Money worries are the biggest source of stress for Canadians: more than work, personal health, or even relationships. Canadians can avoid this stress by adopting a handful of financial strategies and sticking to them. It’s important to keep in mind that making a budget or consolidating your debt won’t solve all of your money problems overnight, just like getting that new gym membership won’t suddenly make you a marathon runner. Improvements to your financial health, like your physical health, are incremental, the sum total of thousands of little decisions you make every day to maintain your commitment to yourself and those you rely on.

Optimizing Your Financial Health

Up for the challenge? Here are a few ways to get started:

Know the Difference Between Good and Bad Debt: Debt isn’t always bad. Sometimes, taking on debt in the present can help mitigate financial problems in the future, provided that that debt is being used to create value, or to produce wealth in the long term. Depending on your location, renovating your home- thereby increasing its resale value- could be a valid reason to take on debt. Taking on a student loan in order to acquire the necessary credentials to get a better-paying job is another example of a debt that could more than pay for itself in the long run.

Make a Budget to Manage Your Money: Simply keeping track of how much you earn, spend, and save can radically change your outlook on your finances. By clarifying your financial situation, you may find it easier to set limits on your spending and live within your means, as well as feel more inclined to be proactive in looking for ways to reduce or eliminate costs.

Set up an Emergency Fund: When you have money set aside for unexpected expenses, you can handle those expenses without having to go into debt or accept high-cost loans to make up the deficit.

Avoid Debt by Saving up for Your Financial Goals: When you not only identify but commit to paper (digital or otherwise) your financial goals, you may feel more accountable when it comes to whether or not you achieve them. It can be all too easy for financial aspirations to appear impossible or abstract: when you itemize your goals with specific dollar values and time frames, it becomes easier to see how far you’ve come, and how far you’ve left to go.

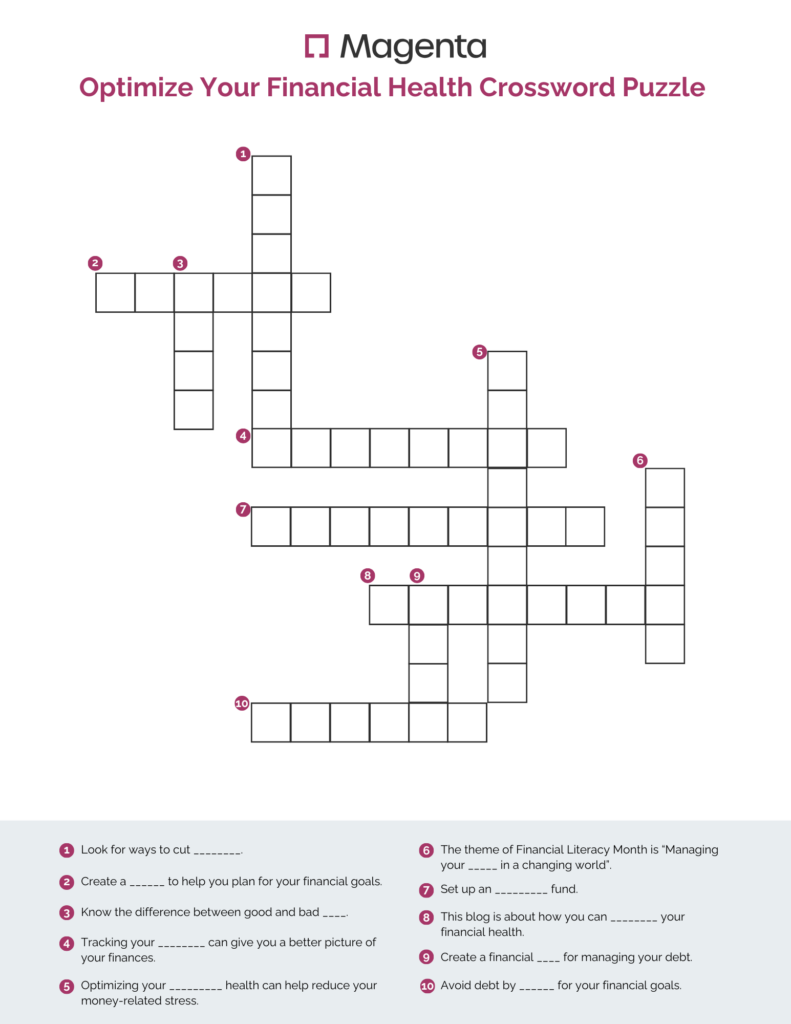

Financial Health Crossword Puzzle

Did you get all the words right? Click here to see the Crossword Answer Key.

Tune in next week to learn more about our final topic: knowing your financial rights. To learn more about Financial Literacy Month and see additional resources provided by the FCAC, please click here.