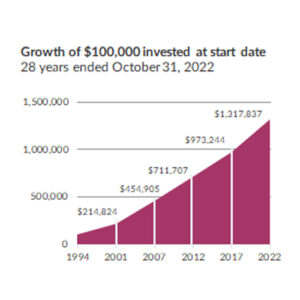

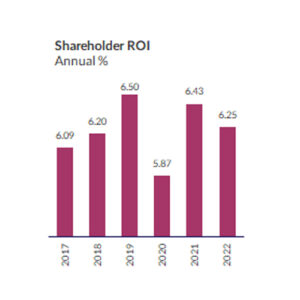

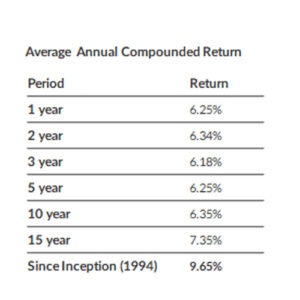

A 30-year track record of reliable income and strong returns.*

Summer has begun! Airlines are booked for family vacations abroad while the beaches here in Ontario will host crowds of people. Cottages and campsites will see loved ones enjoying outdoor sports, campfires, and quality time. That’s what summer is all about – resetting, clearing our heads and choosing how we want to spend our valuable time and energy – whether that’s through self-care or making memories with loved ones.

But how do we achieve a carefree summer in a world where we are overly scheduled and carrying the mental load of current events, money, and more specifically, investments? We know we should build for our future and our children’s futures, and that pressure can be stressful…but it doesn’t have to be.

Since 1994, our goal at Magenta has been to empower our investors to build for their tomorrows and achieve peace of mind by applying a conservative portfolio strategy to deliver reliable income and strong returns. As one of Canada’s largest and most established MICs, we have maintained our strong track record by financing quality residential real estate in carefully selected Ontario markets.

Continue reading for more information on our performance history, portfolio strategy, examples of financing and fund details, as well as contact information to start investing today!

Investing with Magenta offers:

- Regular income

- Liquidity

- Flexibility

Performance History

To learn more about investing with Magenta, e-mail shareholders@magentainvestment.ca.

Are you an Investment Advisor? Click here for more information.

How We Manage Our Portfolio

We have a risk-mitigated portfolio strategy. This means we know our markets intimately and we assess our borrowers and their homes thoroughly. We acquired this knowledge over three decades and evolved to become industry experts, assuring you and your family peace of mind.

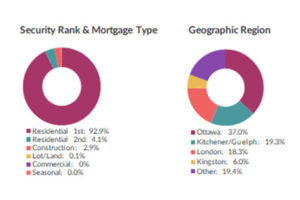

- Stable Ontario markets

We lend exclusively in Ontario with a focus on areas with a large public-sector workforce. Ottawa, Kitchener, Guelph, London and Kingston make up most of the geographical areas in the portfolio. - Quality residential real estate

Magenta mortgages are secured by highly marketable, quality residential real estate with a heavy overweighting of first mortgages secured by owner-occupied single-family homes. - Short-term lending

Typically, our borrowers sign for a one-year mortgage term. A one-year term allows for regular turnover, generating application and renewal fees. It also allows our rates to stay tied to prime so that Magenta returns are closely linked to market interest rates. - Industry expertise

We have a 30-year track record of delivering reliable and consistent returns.

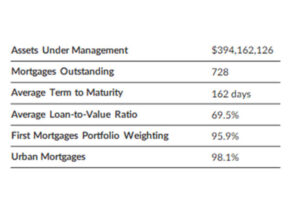

Portfolio Composition:

Examples of Financing

Our Investor Relations Team

Our Investor Relations Team has combined experience of over 60 years in the mortgage and financial industry. Our collective experience includes strategic oversight, operational risk management and building and maintaining client relationships. We pride ourselves on our excellent customer service and operational excellence. This means you have easy access to not only speak with someone but receive best-in-class service and communication that reassures you every step of the way – from the moment you connect with us to the moment you feel like you’ve finally built for your tomorrow.

Big or small, every investment is a step toward your world of possibility. There is no better time to invest in Magenta than now. After all, 2023 is the year of Magenta.

To find out more on how you can invest in Magenta reach out to Allison Daines Allen at shareholders@magentacapital.ca.

Allison Daines-Allen

Manager, Investor Relations

shareholders@magentacapital.ca

Direct: 613-699-4939

Toll-free: 1-888-267-1744

Investment Advisors:

Click here for our subscription forms.

To learn more or speak with someone at Magenta reach out to Greg Sinclair or Daniel Werner:

Greg Sinclair

COO

gsinclair@magentacapital.ca

Direct: (613) 699 4963

Toll-free: 1-888-267-1744

Daniel Werner

Account Manager, Investment Advisors

dwerner@magentacapital.ca

Direct: (613) 699 6485

Toll-free: 1-888-267-1744

*This article does not constitute an offer to sell securities and should be read in conjunction with the offering memorandum dated March 28th, 2023, available for download at this link or from our office. Investors should read the offering memorandum before investing. The foregoing historical performance achieved by the Corporation is not a guarantee of future results.